Highlights of Budget 2021, Union budget 2021

Highlights of Budget 2021: Agri cess of Rs 2.5 on petrol and Rs 4 on diesel proposed, FDI up to 74% in the insurance sector,

Extra discount of Rs 1.5 lakh in interest for a home increased for 1 year

As in income tax, no slab has been changed - no exemption has been granted.

With the help of NGO, state government, and private sector, 100 new soldier schools will be started

20,000 crore will be invested in government banks. Reconstruction company and asset management company to be set up to get banks rid of NPAs.

Highlights of Budget 2021

Finance Minister Nirmala Sitharaman presented the general budget on Monday. The government has proposed to increase agri cess of petrol by Rs 2.5 and diesel by Rs 4. At the same time, the FDI limit in the insurance sector has been increased from 49 percent to 74 percent. The middle class got nothing in the budget. The government has not made any changes in the income tax slab and has not given any exemption. However, the period of extra rebate of up to Rs 1.5 lakh in interest on affordable housing has been extended by one year till March 2022, while pensioners above the age of 75 are exempted from filing income tax returns.

Big budget talk

Big tax-linked ads

On the 75th anniversary of independence, we want to provide relief to senior citizens aged 75 and above. He no longer needs to file an IT return.

At present, a case can be opened even after 6 years of tax reassessment and 10 years in a serious case. It has now been reduced to 3 years. In a serious case, if the issue is to hide more than Rs 50 lakh in a year, the case can be opened for 10 years. Only the commissioner will approve it.

Tax disputes worth Rs 85,000 crore have come to an end recently. A Dispute Resolution Committee will be formed, with people with income up to Rs 50 lakh and disputed income up to Rs 10 lakh going to the committee. There will be a National Faceless Appellate Tribunal.

At present, if the turnover exceeds Rs 1 crore, a tax audit will have to be done. The exemption for 95% digital transactions was increased to 50 million last time. It has now been increased to 10 crores.

TDS will no longer be levied on dividend payments

Home is a priority for everyone. A provision of Rs 1.5 lakh was made in interest on the home loan. Now an extra rebate of Rs 1.5 lakh in interest for affordable housing has been kept till March 31, 2022.

Custom duty

400 old discounts will be reviewed. This will be done on the basis of advice. The revised customs duty structure will start from October 1 this year.

Customs duty on iron and steel is being reduced to help metal recyclers. Duty will also be removed in Copper Scape.

Gold and Silver are currently subject to 12.5% customs duty, which will be rationalized. Auto parts will be subject to 15% customs duty.

To help farmers, 10% customs duty will be levied on cotton, 15% on raw rations, and ration weaving.

Vehicle scraping

A voluntary vehicle scrapping policy will be introduced to remove old vehicles. This will help reduce pollution.

The vehicles will be fitness tested. The personal vehicles will be scrapped after 20 years and commercial vehicles after 15 years.

The political deficit is projected to narrow

"We have increased government spending since the end of the lockdown," the finance minister said. Government expenditure is estimated at Rs 30.42 lakh crore in 2020-21, which will increase to Rs 34.5 lakh crore. The political deficit in 2021 is 9.5% of GDP. We need Rs 80,000 crore more to compensate for that. That is what we expect from the market. Government expenditure is estimated at Rs 34.83 lakh crore in 2021-22. The political deficit is projected to be 6.8 percent of GDP in 2021-22. It is projected to be reduced to 4.5 percent by 2025-26. The contingency fund has been increased from Rs 500 crore to Rs 30,000 crore.

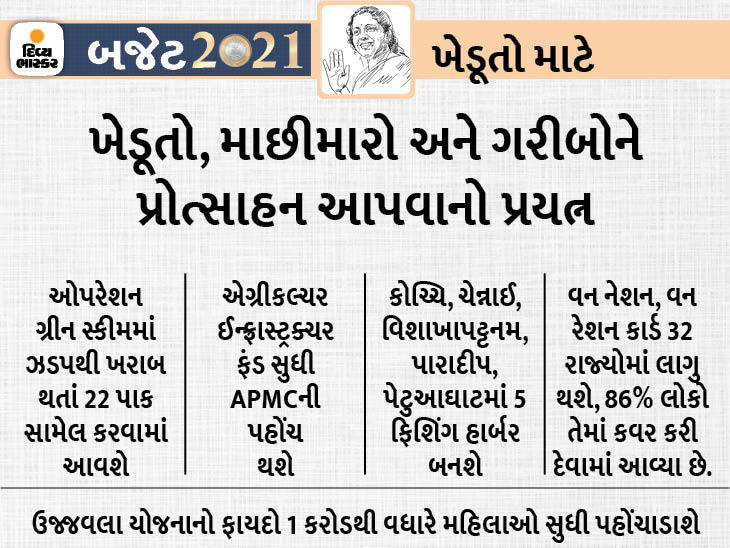

For farmers Highlights of Budget 2021

The agriculture credit target in 2021-22 is Rs 16.5 lakh crore. Operation Green Scheme will cover 20 crops that are deteriorating rapidly.

APMC will also have access to the Agriculture Infrastructure Fund. 5 big fishing harbors will be built in cities like Kochi, Chennai, Visakhapatnam, Paradip, and Petuaghat. A multipurpose sea-weed park will be set up in Tamil Nadu.

For the poor

One Nation, One Ration Card will be approved in 32 states. 86% of people are covered in it.

The benefits of the Ujjawala scheme will be extended to 1 crore more women.

For education Highlights of Budget 2021

With the help of NGOs, state government,s, and private sector, 100 new soldier schools will be started.

Central University will be set up in Leh for higher education in Ladakh.

750 Eklavya Model School facilities will be improved in the tribal area.

35219 crore will be spent in 4 years for 4 crore children of Scheduled Castes.

Post-matric scholarships will also be offered for tribal children.

For the insurance and banking sectors

Insurance X 1938 will be amended. FDI in the insurance sector will be increased from 49% to 74%.

IDBI will be investing in two banks and one public sector company as well. The law will be changed for that. An IPO for LIC will also be brought.

20,000 crore will be invested in government banks. A reconstruction company and an asset management company will be set up to rid banks of NPAs.

For health Highlights of Budget 2021

Emphasis will be placed on nutrition. Mission Nutrition 2.0 will be launched. Water supply will be increased

Water-life missions will be launched in urban areas. 1.48 lakh crore will be spent on Urban Clean India Mission in 5 years

The pneumococcal vaccine will be launched across the country. It will save the lives of 50,000 children every year.

With a budget of Rs 64,180 crore, the Prime Minister's Self-Reliant Healthy India Scheme will be launched, in the same budget new diseases will be treated.

Critical Care Hospital will be started in 602 districts. The National Center for Disease Control will be strengthened.

An Integrated Health Information Portal will be launched to connect public health labs. 15 Health Emergency Operation Centers will be started.

For infrastructure

There is a need for a Development Financial Institute for the infrastructure sector. A bill will be brought for that. Rs 20,000 crore will be spent on it to build a lending portfolio of Rs 5 lakh crore in 3 years.

The focus will be on monetizing public infrastructure. The National Monetization Pipeline will be launched. It will have a dashboard to keep an eye on these cases.

The National Highways Authority will also attract international investment. Railways will also monetize the freight corridor. Monetization will also be considered in any future airport.

For railways

Railways have formulated the National Rail Plan 2030 to build a futuristic railway system and reduce logistical costs. Eastern and Western Dedicated Freight Corridor can be prepared by June 2022. The Srinagar-Gomo section will be built in PPP mode.

The Gomo-Damakuni section will also be made this way. Future Ready Corridor will be constructed at Kharagpur-Vijayawada, Bhusawal-Kharagpur, Itarsi-Vijayawada. By December 2023, 100 percent broad gauge electrification will be done.

Vista Dom coaches will be launched so that passengers have a good experience. Train protection system will be introduced on high-density network, high utilized network. This system will be developed in the country.

1.10 lakh crore is being given to railways. 1.07 lakh crore is for capital expenditure only.

For the metro

A bus transport system will be introduced in the urban area. 20 thousand buses will be ready. This will help the auto sector and increase employment.

702 km metro is currently running. Work is underway on a total of 1016 km metro in 27 cities. Metro lights and Metro Neo will be launched in low-cost Tier-2 cities.

Kochi Metro will have an 11 km stake at a cost of Rs 1,900 crore. Chennai will have a 180 km long metro route at a cost of Rs 63,000 crore.

Bengaluru will also have a 58 km long metro line at a cost of Rs 14,788 crore. Nagpur will get Rs 5,976 crore and Nashik Rs 2,092 crore.

For 3 states with elections

Rs 3.3 lakh crore has been provided for the Bharatmala project. Economic corridors will be created for road infrastructure. The 3500 km National Highway project will cost Rs 1.03 lakh crore in Tamil Nadu, with construction starting next year.

The 1100 km National Highway will be built in Kerala, including the Mumbai-Kanyakumari corridor. In Kerala, Rs 65,000 crore will be spent on this.

Highways will be built in Bengal at a cost of Rs 25,000 crore. The Kolkata-Siliguri road will be upgraded. Rs 34,000 crore will be spent on the National Highway in Assam.

Mention of Team India's victory

Sitharaman said that today India has become a country of hopes. Rabindranath Tagore said that hope is a bird that chirps even in the dark. Team India recently had a great performance in Australia, which reminded us of what kind of quality we have. Today data shows that India has the lowest mortality rate due to corona. All this is a sign of the transformation of the economy. Only three times so far the budget has been presented after the negative GDP figures. This time the negative figures are due to the worldwide epidemic.

"I am presenting the budget for 2021-22. As soon as the lockdown ended, the Prime Minister announced a poor welfare scheme, which provided free food to 800 million people. 80 million people got free cooking gas. I would like to thank all those who have been involved in delivering the service to the needy. We then brought two more self-contained packages. We gave a total relief of 13 percent of GDP or Rs 27.18 lakh crore.

Highlights of Budget 2021

Finance Minister Nirmala Sitharaman reached the Parliament House after handing over a soft copy of the budget to President Ramnath Kovind. A cabinet meeting was held here in which the budget was approved. This will be Nirmala Sitharaman's third budget. Both the general public and the business world have high hopes for this budget. The reason for hope is his statement given on December 18 last year. He said this time the budget would not have come in the last 100 years. The Economic Survey, tabled in Parliament on February 29, has many indications of this.

Krishnamurthy Subramaniam, chief economic adviser who prepared the economic survey, said the time has come for the government to increase its spending and reduce the tax burden on the people. However, private companies are not in a position to increase costs at present. That is why the government has to increase the expenditure, but the government is short of money for the expenditure. That is why there is little hope of tax relief. Conversely, there is talk of imposing a corona cess, even if it seems to be on higher-earning companies.

Budget Speech English PDF

The stock market plunged about 2.5% on the budget day last year

On a budget day, there are many ups and downs in the stock market. The market has suffered losses four times in the last six budgets of the Modi government, one of which was the interim budget. Last year on Budget Day (February 1) the market closed with a decline of 2.43%.

For Best View Please Open This Website In CHROME / OPERA Browser

No comments:

Post a Comment